#MARKET RESEARCH #RETAIL LANDSCAPE #POST-PANDEMIC ERA #OFFLINE SALES #SALES DECLINE #IN-STORE FOOT TRAFFIC # RETAIL CHANNELS #APPAREL AND FOOTWEAR SPECIALISTS #BEAUTY SPECIALISTS #VENDING #INTERNATIONAL TRAVEL #RETAIL E-COMMERCE #MERCHANT DIGI GLOBAL

SINGAPORE

By IFAB MEDIA - NEWS BUREAU - September 25, 2023 | 1034 8 minutes read

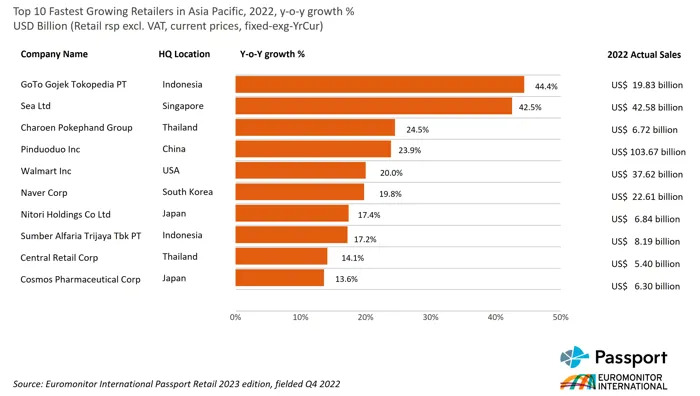

- Indonesia’s GoTo leads the way among the Top 10 Fastest Growing Retailers in Asia Pacific for 2023, boasting an impressive year-on-year growth rate of 44%.

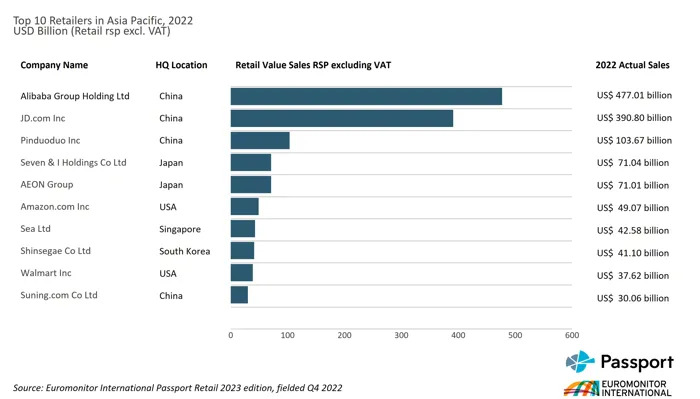

- China’s Alibaba secures top spot among the Top 10 Retailers overall in Asia Pacific, achieving nearly US$ 500 billion in retail value sales.

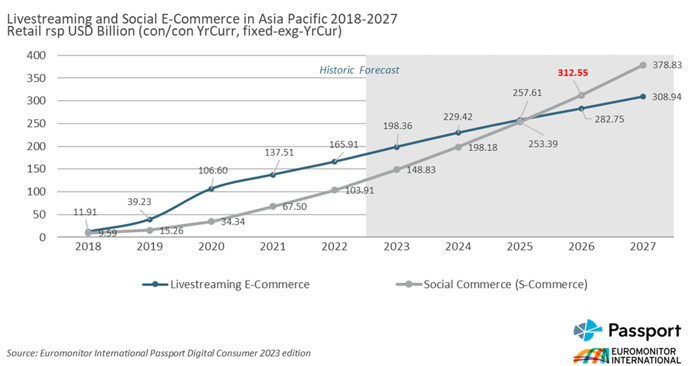

- Social e-commerce is forecast to hit more than US$ 300 billion in retail value sales by 2026, surpassing livestreaming e-commerce.

Research released by market research company Euromonitor International has today revealed 2023’s top 10 fastest growing retailers and the top 10 biggest retailers overall in the Asia Pacific.

Euromonitor International’s report on the retail landscape in the Asia Pacific region looked at the new chapter in the retail industry across physical and digital channels, as the sector and consumers alike enter the post-pandemic era.

In retail offline sales, China’s stringent lockdown policies led to a 4% decline in sales in absolute dollar terms as reduced in-store foot traffic became a challenge. However, markets like India, Indonesia and South Korea experienced strong growth, with sales surging by 14%, 10% and 4%, respectively. Euromonitor explained that this revival benefitted various retail channels, particularly apparel and footwear specialists, beauty specialists, and vending, as international travel resumed and lockdown restrictions were lifted.

Retail e-commerce largely continued its strong growth in Asia Pacific in the wake of the pandemic, driven by merchant digitalisation and consumer habit persistence. Differing strategic priorities and initiatives in Asia Pacific have provided the e-commerce market with unique growth opportunities; Social e-commerce thrives in the future retail market as a powerful tool for retailers to engage consumers. Social e-commerce is expected to surpass the livestreaming e-commerce market by 2026, reaching retail value sales of more than US$ 300 billion.

Euromonitor attributed this to increased social media usage since the pandemic as high mobile penetration rates have provided a conducive environment for social e-commerce to flourish.

Top 10 fastest growing retailers: GoTo registers 44% YoY growth

Amidst the dynamic and competitive retail landscape in 2022, Indonesia’s GoTo Gojek Tokopedia PT and Singapore’s Sea Ltd emerged as standout performers, achieving retail sales growth rates of 44% and 43%, respectively. The majority of retailers featured in the rankings also operate in retail e-commerce, underlining the channel's significance and enduring growth in the post-pandemic era.

1Top 10 Fastest Growing Retailers in APAC 2023 - figures in chart are reflected in % to showcase the current status of these growing retailers in APAC .

Euromonitor’s data highlighted two retail powerhouses from e-commerce and offline respectively. Sea Ltd, securing the second position in top 10 fastest retailers in APAC in 2022, shone with its flagship mobile-first e-Commerce marketplace Shopee. Shopee's hyper-localisation, competitive pricing, and extensive product range, coupled with engaging features like livestreaming and interactive games, fostered continued consumer engagement.

Further, Nitori, a leading Japanese home products specialist, showcased exceptional expansion beyond Japan into mainland China, Taiwan, Malaysia, and Singapore. With 77 new outlets in the pipeline, Nitori remained at the forefront of regional growth.

Experiential retail evolves with cutting-edge technology

In the wake of the pandemic, consumers have returned to physical stores, seeking immersive and extraordinary shopping experiences. Experiential retail has taken centre stage, emphasising this shift as brands reimagine their stores to be more than mere transaction points.

Leading the way in Southeast Asia, Watsons' "The Grand Store" in the Philippines embraced the power of Artificial Intelligence (AI) and Augmented Reality (AR) in its in-store tools. These cutting-edge technologies have enabled shoppers to analyse their skin conditions and virtually try on cosmetics, facilitating personalised and confident purchase decisions. This ground-breaking has approach elevated the shopping journey, marking a new era of innovative retail experiences.

Focus shifts towards innovation to boost customer satisfaction in e-commerce

E-commerce marketplaces have emerged as a convenient and accessible option for retailers venturing into digitalisation in developing markets in Asia. In developed countries, the focus shifted towards innovation to meet the rising consumer expectations in e-Commerce, including improvements in product assortment and fulfilment flexibility.

SSG.COM, South Korea's retail giant Shinsegae's e-commerce portal, implemented a "premium strategy" by introducing luxury brands like Gucci, Ferragamo, Burberry, and Montblanc on its platform. Another South Korean e-commerce player, Naver Shopping, is redefining consumers’ delivery expectations by launching its “Naver Guaranteed Delivery Programme” with CJ Logistics to provide overnight delivery to over 90% of South Korea’s region.

Quan Yao Peh, Senior Analyst at Euromonitor International said: “The retail industry witnessed a dynamic transformation fuelled by the post-pandemic shifts towards experiential retail and social e-commerce. Supported by the two powerful engines of increased social media usage and integration of new technologies, the post-pandemic Asia-Pacific retail landscape remains competitive.”

2Top 10 Retailers in APAC 2023 - figures in chart are reflected in retail value sales and differed from Top 10 Fastest Growing Retailers in APAC 2023 as they show the current Retailers in the present year with global historical figures taken .

Industry giants like Alibaba Group Holding Ltd, JD.com Inc and Pinduoduo Inc continue to reign at the top of the rankings, driven by their substantial domestic consumer base, attractive pricing, and streamlined fulfilment capabilities.

Alibaba Group Holding Ltd witnessed an impressive 4% market growth rate from 2021 to 2022 from US$ 459 billion to 477 billion, while JD.com saw a substantial increase of 11% from US$ 352 billion to 391 billion, solidifying their positions as leading players in the dynamic e-commerce landscape.

Quan Yao Peh commented: “There has never been a greater variety of choices across physical and digital channels, and technology and digital tools will continue to transform the way retailers engage and sell to consumers. Retailers are facing new and unprecedented challenges, and those able to turn this into an opportunity are well placed to remain the preferred shopping destination of consumers.”

Euromonitor international It is the world’s leading provider of global business intelligence, market analysis and consumer insights. From local to global and tactical to strategic, our research solutions support decisions on how, where and when to grow your business. With offices around the world, analysts in over 100 countries, the latest data science techniques and market research on every key trend and driver, we help you make sense of global markets.