INDIA-UK CETA TEXTILE INDUSTRY GARMENT EXPORTS UK MARKET TRADE AGREEMENT GDP CONTRIBUTION EMPLOYMENT READY-MADE GARMENTS COTTON MAN-MADE FIBRE HUMAN PROTECTION WEAR IMPORT DUTIES MMF RAW MATERIALS TECHNICAL TEXTILES GLOBAL TRADE SUSTAINABLE NATIONAL

AHMEDABAD, GUJARAT, INDIA

By IFAB MEDIA - NEWS BUREAU - August 3, 2025 | 878 11 minutes read

It was an exciting last week.

India’s textile and garment industry has received a major boost after the Comprehensive Economic and Trade Agreement (CETA) with the UK.

Here’s my take on why this pact matters and what we must do next to capitalise on this.

The India–UK Economic Tapestry

Source: Global Economic News

Source: Global Economic News

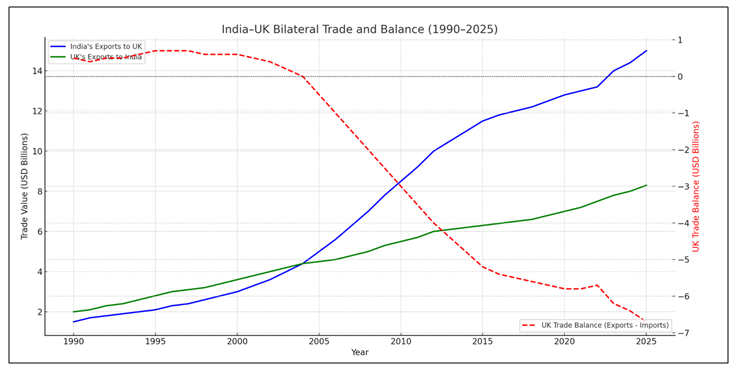

Back in the early 90s when India was opening up, annual trade with the UK barely registered. Fast forward to the present, it stands at $ a year.

This shows India’s rapid growth and Britain’s focus on India as a strategic market.

Interestingly, the UK was India’s #2 trading partner in the late 1990s. Today, as India’s trade has diversified with partners like the EU, US, China, and the Middle East, the UK ranks around 18th in India’s export markets.

On the flip side, India’s importance for UK trade has risen: by 2024, India became the UK’s 11th largest trading partner, accounting for about 1.79% of its global trade.

By 2019 bilateral trade reached $30 billion, and continued to rise post-pandemic, hitting $54.9 billion in the four quarters to Q3 2024. Investment is strong too: as of 2023, UK FDI stock in India was $23.3 billion, while Indian FDI stock in the UK was $17.6 billion.

India’s Textile Engine

Our textile and apparel industry contributes 2.3% to India's GDP. Over 45 million people are employed because of it. It generates one-tenth of India’s export earnings.

We are the world’s second-largest producer of textiles and garments, and the sixth-largest exporter, spanning apparel, home, and Human Protection Wear. We hold a 4.6% share in global textile and apparel trade.

Total exports during FY25 stood at $36.61 billion, led by ready-made garments (44%), followed by cotton (33%) and man-made textiles (13%). Textile exports are expected to reach $65 billion by FY2026.

The UK Opportunity – Pre and Post-CETA

Before this agreement, Indian textile and apparel exports to the UK faced 10-12% import duties, while other countries enjoyed zero duty under their LDC status. This diminished India’s competitive edge despite our quality.

India is currently the fourth-largest supplier of textiles and apparel to the UK with a 6.6% market share. The CETA is expected to unlock significant growth.

The Advantage India strategy

Western buyers are increasingly diversifying away from traditional sourcing hubs due to cost, compliance, and political risk.

Recent numbers indicate this shift:

- Indian apparel exports grew 11.3% YoY in May 2025, despite flat global demand.

- The Confederation of Indian Textile Industry (CITI) projects the $120 billion market as “the single biggest window” for India, provided raw material costs remain competitive.

Major global brands have already begun engaging with Indian manufacturers. If India captures even 10% of another country’s current share, it could generate half a million new jobs domestically.

This is the moment for Indian brands to capitalize on their vertically integrated capacities, design studios, and sustainable manufacturing platforms.

The Human Protection Wear

Cotton remains a core strength, but the real potential lies in man-made fibre (MMF) and Human Protection Wear. India’s market for these products is currently the 5th largest globally and is projected to grow to $23.3 billion by 2027, with the global market expected to reach $309 billion by 2047.

Globally, 70% of textile consumption is MMF based, but India’s product mix remains the opposite. In the global MMF and technical textile segments, India’s market share is still modest.

With strategic policy support, these numbers could grow by 25-30% over the next five years.

CETA aligns with these ambitions. The UK’s defence-industrial roadmap with India, signed alongside the trade agreement, emphasizes co-development of high-performance materials for aerospace and mobility platforms further validating the focus on Human Protection Wear.

To fully harness this opportunity, policymakers must remove import duties on MMF raw materials like polyester and viscose and eliminate Quality Control Orders (QCOs). These steps would improve cost competitiveness and attract global clients.

The way forward

Key action points ahead include:

- Expanding capacity in MMF and Human Protection Wear before new demand surges.

- Investing in R&D and innovation to boost design and sustainability leadership.

- Embracing closed-loop recycling and traceable, circular apparel to meet retailer expectations.

- Using government incentives to build skills for next-gen manufacturing.

- Leveraging FTAs for joint innovation—not just tariff reductions.

The India–UK CETA is a start, if industry and government continue to collaborate, we can take Indian textile and apparel exports from $40 billion to $100 billion before 2030.

Sources:

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2147805

https://www.globaleconomicnews.au/opinions/uk-india-a-modern-economic-amp-trade-perspective

https://www.ibef.org/industry/indian-textiles-and-apparel-industry-analysis-presentation

https://unctad.org/system/files/official-document/ditccom2025d2_en.pdf

|

KULIN LALBHAI, VICE CHAIRMAN, ARVIND LIMITED

He is driving the consumer and digital businesses at Arvind which includes Arvind fashions, real estate and telecom. He has been appointed as the Honorary Consul of Finland in Gujarat recently.

He has been instrumental in setting up several new retail concepts for the group. He has been involved with expanding the brand portfolio at Arvind fashions and also its foray into footwear. Arvind fashions has emerged as one of India’s leading brand houses with a marquee portfolio of brands like US Polo, Arrow, Flying machine, Tommy Hilfiger and Calvin Klein. It operates more than 1200 stores, 3000 shop-in-shops and has a leadership position in the E-commerce space.

Kulin has been closely involved in the group’s foray into real estate. Arvind Smartspaces is emerging as one of India’s fastest growing companies in the residential segment with a focus on Ahmedabad, Bangalore and Pune. With over 15mn. square feet of projects under execution, Arvind Smartspaces hopes to emerge as a top developer in the country in the coming years.

Kulin has been driving the digital transformation agenda at Arvind. Under his leadership Arvind fashions has transformed from being an offline retailer to a leading omni channel brand company. Kulin has also incubated digital start-ups within the group such as Omuni which recently was merged with Shiprocket, a logistics focussed unicorn.

Kulin drives the corporate affairs function at Arvind. He holds a leadership position in several industry bodies. He is the Chairman of CII National committee on textiles and apparel and also heads the CII subcommittee on the India-EU FTA negotiations. He was also the Chairman of CII Gujarat State Council (2024-25). He is the Vice Chairman of RAI, the leading industry body for Indian retail. Besides sitting on the boards of group companies he is also an independent director on the board of Zydus Wellness.

Kulin holds an MBA from the Harvard Business School, and a BSc in Electrical Engineering from the Stanford University. Prior to his current role, he has also been a management consultant at Mckinsey & Co. |

ABOUT ARVIND LTD Arvind is a textile to retail conglomerate with focus on textiles, apparels, advanced materials, environmental solutions, telecom and Omni-channel commerce. Arvind Limited is an integrated solutions provider in textiles with strong fiber to fashion capabilities for a global customer base. It is also a design powerhouse implementing innovative concepts and generating intellectual property. It ranks amongst the top suppliers of fabric worldwide. The company strives every day to create opportunities beyond conventional boundaries and believes that the possibilities are endless. For more information, please visit https://www.arvind.com/