CANTABIL RETAIL INDIA LIMITED FINANCIAL RESULTS Q2 FY26 H1 FY26 REVENUE GROWTH EBIDTA PAT SAME STORE SALES GROWTH BRAND EQUITY OPERATIONAL EXCELLENCE RETAIL EXPANSION 630 STORES CUSTOMER EXPERIENCE VALUE FASHION CONSUMER SENTIMENT MACROECON NATIONAL

NEW DELHI, INDIA

By IFAB MEDIA - NEWS BUREAU - November 4, 2025 | 612 9 minutes read

Cantabil Retail India Limited (CRIL / Company), one of India’s leading integrated retail player with pan India presence declared its Financial Results for the quarter and half year ended September 30, 2025. CRIL with over 3 decades presence is in the business of designing, manufacturing, branding and retailing of apparels under the brand name of CANTABIL.

Key Financial Highlights are as follows :

|

Particulars (₹ In Cr) |

Q2FY26 |

Q2FY25 |

Y-O-Y |

H1 FY26 |

H1 FY25 |

Y-O-Y |

|

Revenue from Operations |

176.0 |

151.1 |

16% |

334.7 |

278.7 |

20% |

|

EBIDTA |

42.1 |

34.5 |

22% |

91.1 |

73.9 |

23% |

|

EBIDTA Margin |

23.9% |

22.8% |

|

27.2% |

26.5% |

|

|

PAT |

6.8 |

6.6 |

3% |

21.4 |

18.0 |

19% |

|

PAT Margin % |

3.8% |

4.3% |

|

6.4% |

6.4% |

|

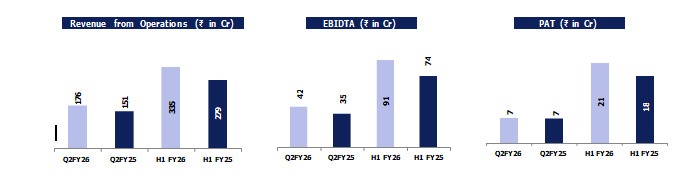

Standalone Performance highlights for H1 FY26

- Revenue from Operations for H1 FY26 grew by 20% to ₹7 crores as compared to ₹278.7 crores in H1 FY25.

- EBIDTA for H1 FY26 grew by 23% to ₹1 crores as compared to ₹73.9 crores in H1 FY25. EBIDTA margin for H1 FY26 stood at 27.2% as compared to 26.5% in H1 FY25.

- PAT for H1 FY26 grew by 19% to ₹ 4 crores as compared to ₹18.0 crores in H1 FY25. PAT margin for H1 FY26 stood at 6.4% as compared to 6.4% in H1 FY25.

Standalone Performance highlights for Q2 FY26

- Revenue from Operations for Q2 FY26 grew by 16% to ₹0 crores as compared to ₹151.1 crores in Q2 FY25.

- EBIDTA for Q2 FY26 grew by 22% to ₹1 crores as compared to ₹34.5 crores in Q2 FY25. EBIDTA margin for Q2 FY26 stood at 23.9% as compared to 22.8% in Q2 FY25.

- - PAT for Q2 FY26 grew by 3% to ₹ 8 crores as compared to ₹6.6 crores in Q2 FY25.

- PAT margin for Q2 FY26 stood at 3.8% as compared to 4.3% in Q2 FY25.

Key Updates

SSG for H1 FY26 stood at a robust 6.7%, reflecting strong brand recall and operational execution.

- Revenue for H1 FY26 grew 20% y-o-y to ₹335 crores, driven by higher footfalls and improved

- On the operational front, we continue to scale efficiently, with a total of 630 stores across the country, covering a total retail area of 48 lakh sq. ft. These results affirm the strength of our business model and our ability to drive consistent, high-quality growth.

Commenting on the results and performance, Vijay Bansal, (Chairman & Managing Director) of Cantabil Retail India Limited said: We are pleased to report a strong first half of the fiscal year, marked by robust performance across all key financial and operational indicators. Same-store sales grew in the higher single digits, driving a 20% increase in revenue and a 19% rise in profit after tax (PAT) — clear evidence of our business momentum and operational excellence.

Our performance underscores the growing trust of our consumers, the strength of our brand, and the continued success of our customer-centric approach. Our differentiated value proposition — offering fresh, trend-led fashion with superior affordability and quality — continues to resonate strongly across our markets.

Encouragingly, we are witnessing early signs of a demand recovery, supported by improving consumer sentiment in recent months. The outlook is further strengthened by favorable macroeconomic factors, including forecasts of an above-normal monsoon, which are expected to boost rural demand and discretionary spending.

We believe that companies with strong brand equity, agile execution, and extensive retail reach are best positioned to capture this upswing. Our continued investments in store expansion, product innovation, and customer experience provide a solid foundation for the next phase of growth.

With a resilient business model, healthy balance sheet, and growing consumer loyalty, we remain confident in our ability to sustain our growth trajectory, capitalize on emerging opportunities, and reinforce our leadership in India’s value fashion segment.